According to a Harvard Business Review, over 70 percent of all mergers and acquisitions fail to achieve their anticipated strategic and financial objectives. Failure is often attributed to various factors including management styles, poor communication, loss of key talent, incompatible cultures, lack of trust and uncertainty of long-term goals.

Hence it is very crucial to conduct a detailed due diligence to uncover potential risks and challenges that can impact the success of a merger or acquisition. By thoroughly evaluating the target company's financial, operational, legal, and cultural aspects, the acquiring company can make more informed decisions and mitigate potential pitfalls.

Here are some reasons why due diligence is essential:

Identify Risks and Challenges: Due diligence helps in uncovering potential risks and challenges that may not be apparent at first glance. It allows the acquiring company to assess the target company's financial health, legal compliance, operational efficiency, and potential liabilities. By identifying and understanding these risks, the acquiring company can take appropriate measures to mitigate them or adjust the deal terms accordingly.

Validate Assumptions and Financial Projections: Due diligence enables the acquiring company to validate the accuracy and reasonableness of the target company's financial projections. It helps in understanding the underlying assumptions, revenue drivers, cost structures, and potential synergies. By critically evaluating these projections, the acquiring company can make more realistic assessments of the target company's future performance and determine if the deal aligns with its strategic and financial objectives.

Assess Cultural Compatibility: Cultural integration is a significant factor in M&A success. Due diligence allows the acquiring company to assess the target company's organizational culture, management style, and employee engagement. It helps identify any cultural differences and potential clashes that may impede integration efforts. By understanding these cultural dynamics, the acquiring company can develop a comprehensive integration plan and address cultural challenges proactively.

Retain Key Talent: Losing key talent during or after an acquisition can significantly impact the value and success of the deal. Due diligence provides an opportunity to assess the target company's key employees, their roles, and their level of engagement. It helps in understanding the talent retention risks and developing strategies to retain critical employees post-acquisition. By identifying key talent and addressing their concerns, the acquiring company can minimize disruptions and ensure a smoother transition.

Set Realistic Expectations: Due diligence helps in setting realistic expectations for the acquisition. It provides a clear understanding of the target company's strengths, weaknesses, opportunities, and threats. By having a realistic assessment of the target company's capabilities and limitations, the acquiring company can establish realistic integration plans, timelines, and performance targets. This helps manage stakeholders' expectations and reduces the likelihood of overestimating the benefits or underestimating the challenges associated with the deal.

Negotiate Better Deal Terms: The findings of the due diligence process can serve as a basis for negotiations between the acquiring and target companies. If significant risks or issues are uncovered, the acquiring company can use this information to negotiate better deal terms, such as adjusting the purchase price, structuring earn-outs or contingencies, or requiring specific representations and warranties. Thorough due diligence provides the acquiring company with the necessary leverage to negotiate from an informed position.

Hence, conducting a detailed due diligence process is critical to ensure a successful merger or acquisition. It helps uncover risks, validate assumptions, assess cultural compatibility, retain key talent, set realistic expectations, and negotiate better deal terms. By thoroughly understanding the target company's strengths, weaknesses, and potential challenges, the acquiring company can make more informed decisions and increase the likelihood of achieving the anticipated strategic and financial objectives.

It is very important to follow a pre-defined templated due diligence process to ensure that there are no lose ends in the analysis. Given below is the comprehensive template that can be applied to wide variety of mergers & acquisition use cases. The template is comprehensive and helps in evaluation of the target company's financial, operational, legal, and other relevant aspects to assess its value, risks, and potential synergies with the acquiring company:

Planning and Scope Definition:

- Identify the objectives and strategic rationale behind the M&A transaction.

- Define the scope of due diligence, including key focus areas and specific areas of concern.

- Assemble a due diligence team comprising professionals from various disciplines such as finance, legal, tax, operations, and technology.

Legal and Regulatory Due Diligence:

- Review legal documents, contracts, and agreements, including articles of incorporation, bylaws, shareholder agreements, and material contracts.

- Assess the target company's compliance with applicable laws, regulations, permits, licenses, and certifications.

- Identify any ongoing or potential legal disputes, litigation, or regulatory issues.

Financial Due Diligence:

- Review historical and projected financial statements, including income statements, balance sheets, cash flow statements, and related footnotes.

- Analyze revenue and cost drivers, key financial metrics, and financial performance trends.

- Assess the quality of earnings, working capital, debt structure, and potential contingencies.

- Conduct financial modelling and sensitivity analysis to evaluate the impact of different scenarios on future financial performance.

Operational Due Diligence:

- Evaluate the target company's operations, production capabilities, supply chain, and distribution channels.

- Assess the scalability, efficiency, and effectiveness of operational processes.

- Identify any operational risks, bottlenecks, or areas for improvement.

- Consider potential synergies and integration challenges between the acquiring and target companies.

Commercial Due Diligence:

- Analyze the target company's market positioning, competitive landscape, customer base, and sales channels.

- Assess the strength of customer relationships, sales pipelines, and growth opportunities.

- Evaluate marketing strategies, product/service portfolios, and pricing structures.

- Identify potential risks and opportunities related to market trends, technology disruptions, and changing customer preferences.

Human Resources Due Diligence:

- Review organizational structure, key personnel, and employee contracts.

- Assess human resource policies, benefits, and compensation structures.

- Evaluate workforce capabilities, talent retention, and potential culture clashes.

- Identify any labor or employment-related legal issues.

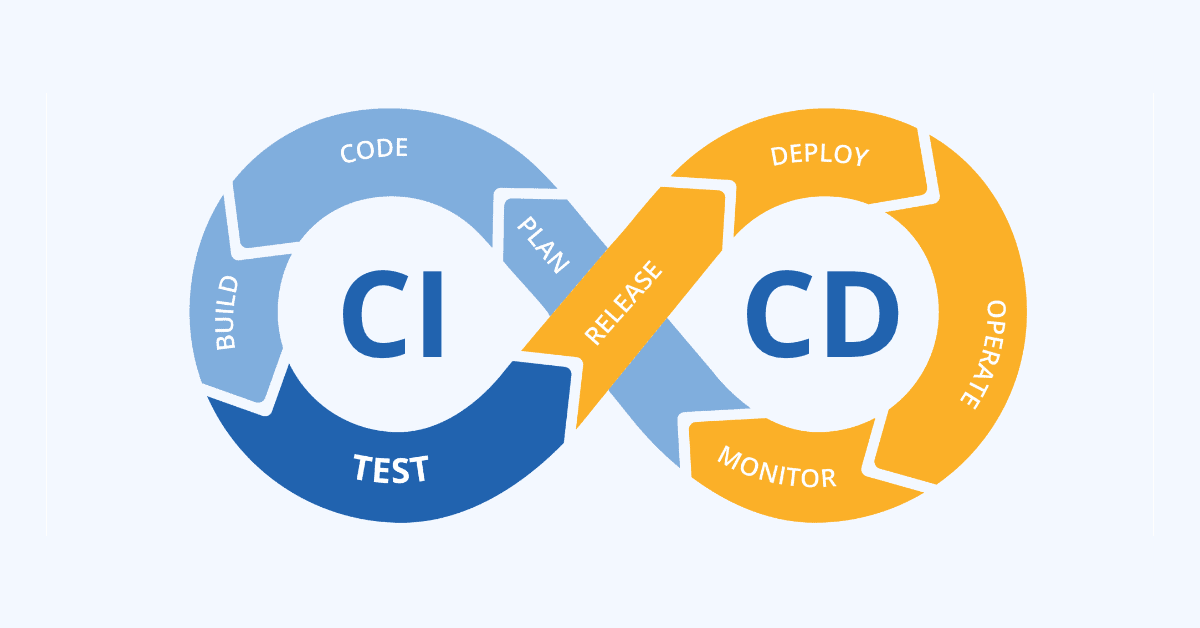

IT and Technology Due Diligence:

- Evaluate the target company's IT infrastructure, systems, and software applications.

- Assess data security, privacy measures, and compliance with relevant regulations.

- Identify any technological risks, including outdated systems or potential integration challenges.

- Evaluate intellectual property rights, patents, copyrights, and licenses.

Environmental and Social Due Diligence:

- Assess the target company's environmental impact, sustainability practices, and compliance with environmental regulations.

- Evaluate social responsibility initiatives, community relations, and reputation management.

- Identify any potential environmental liabilities or social risks.

Risk Assessment and Mitigation:

- Consolidate findings from each due diligence area and identify potential risks and issues.

- Prioritize risks based on their potential impact on the transaction and integration process.

- Develop risk mitigation strategies and contingency plans.

- Quantify and assess the financial impact of identified risks on the valuation and deal structure.

Reporting and Decision Making:

- Prepare a comprehensive due diligence report highlighting the findings, risks, and opportunities.

- Present the report to the acquiring company's management and board of directors.

- Based on the due diligence findings, assess the overall viability and value of the transaction.

- Use the findings to negotiate the deal terms, including purchase price, warranties, representations, and indemnifications.

While this template serves as a basis for many use cases, the specific due diligence process may vary depending on the specific circumstances and industries involved in the M&A transaction. Additionally, legal, financial, and industry-specific experts should be consulted throughout the process to ensure a thorough assessment.