Due Diligence in M&A: A Critical Success Factor

Introduction

Mergers and acquisitions (M&A) are complex business transactions that have the potential to create value, drive growth, and strengthen competitive advantages. However, the alarming statistic from the Harvard Business Review indicating that over 70 percent of M&A deals fail to achieve their strategic and financial objectives serves as a stark reminder of the many pitfalls associated with these transactions. While a range of factors can contribute to M&A failures, one fundamental component that can significantly impact the outcome is due diligence.

Due diligence in M&A involves a comprehensive and systematic process of assessing the target company's financial, operational, legal, and strategic aspects. It is a critical success factor that can mitigate risks, maximize value, and ensure that M&A deals are well-informed and strategic. In this article, we will explore the importance of due diligence in mergers and acquisitions, its key components, and best practices to improve the odds of a successful outcome.

The Consequences of Inadequate Due Diligence

M&A transactions are high-stakes endeavors that carry substantial risks. Without thorough due diligence, these risks become magnified, leading to a wide array of negative consequences. The consequences of inadequate due diligence can include:

Financial Loss: One of the most immediate and significant consequences of poor due diligence is financial loss. This can occur if the acquirer overpays for the target company or if hidden liabilities, undisclosed financial issues, or overestimated synergies become apparent after the deal is completed.

Operational Challenges: Incompatible processes, systems, and cultures can lead to operational inefficiencies post-merger, affecting day-to-day business operations and eroding value.

Legal and Regulatory Issues: Failure to identify legal or regulatory compliance problems during due diligence can lead to costly lawsuits, fines, or even the dissolution of the merger.

Talent Drain: Key talent may choose to leave the organization due to uncertainty or incompatibility, leaving the merged entity without essential expertise.

Erosion of Trust: Failed mergers can lead to a lack of trust among employees, customers, and shareholders, which can be difficult to rebuild.

Key Components of Due Diligence

Effective due diligence in M&A involves a systematic examination of various facets of the target company. The key components of due diligence include:

Financial Due Diligence: This involves a thorough review of the target company's financial statements, balance sheets, income statements, cash flows, and other financial metrics. It helps identify potential financial risks and opportunities.

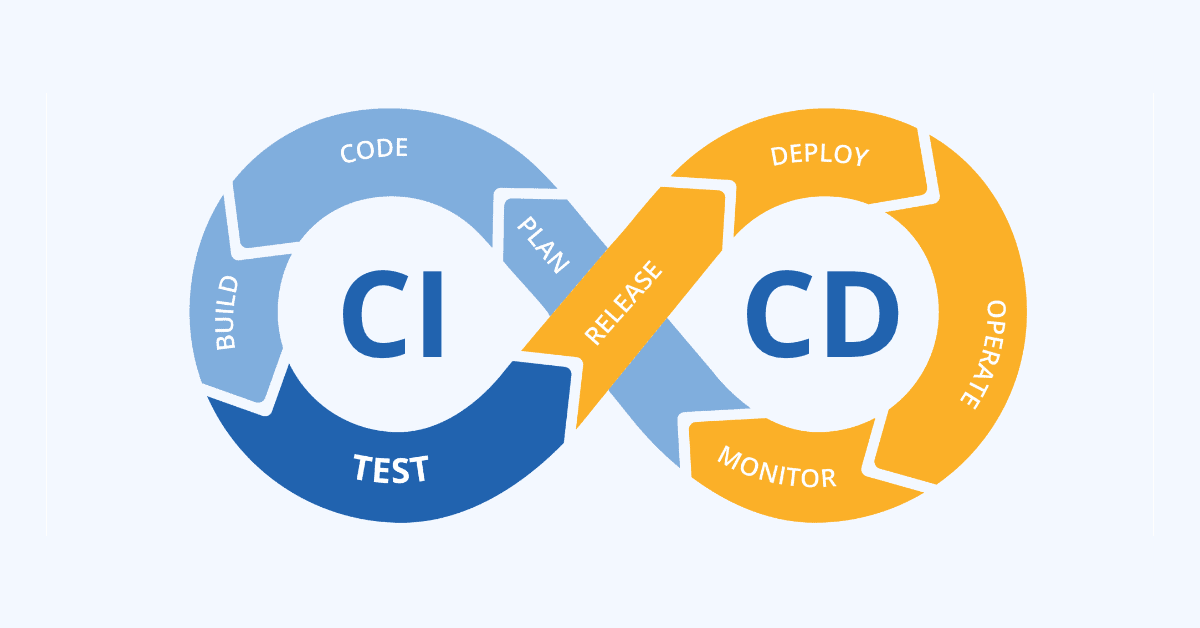

Operational Due Diligence: Examining the operational aspects of the target company includes assessing its production processes, supply chain, technology infrastructure, and operational efficiency. This component is crucial to identifying potential synergies and integration challenges.

Legal Due Diligence: Legal experts review contracts, intellectual property rights, litigation history, compliance with regulations, and any pending legal issues to assess the legal risks associated with the target company.

Market and Competitive Due Diligence: Analyzing the target company's market position, competitive landscape, and growth potential helps determine its strategic fit within the acquiring organization.

Cultural Due Diligence: Understanding the corporate culture and assessing compatibility with the acquirer's culture is crucial for preventing post-merger cultural clashes.

Best Practices for Effective Due Diligence

To increase the chances of a successful M&A deal, organizations should adhere to best practices for due diligence:

Early Involvement: Start the due diligence process as early as possible in the M&A journey to gather relevant information and assess risks from the outset.

Cross-Functional Teams: Form multidisciplinary teams that include financial, operational, legal, and cultural experts to ensure a comprehensive examination of the target company.

Rigorous Documentation: Maintain a well-organized and thorough record of the due diligence process to facilitate informed decision-making.

Scenario Planning: Evaluate potential future scenarios, including integration plans, to understand how the merger will impact the business and identify potential risks and opportunities.

Communication and Transparency: Maintain open and honest communication between the acquiring and target companies to build trust and mitigate uncertainties.

Expert Advisors: Engage experienced M&A advisors, consultants, and legal counsel to provide guidance and expertise throughout the due diligence process.

Conclusion

Due diligence is a critical success factor in mergers and acquisitions. It helps organizations identify and assess potential risks and opportunities associated with a target company, thereby improving the odds of a successful M&A deal. By diligently examining financial, operational, legal, cultural, and strategic aspects, organizations can make more informed decisions and increase the likelihood of achieving their anticipated strategic and financial objectives in the dynamic and high-stakes world of M&A. The consequences of inadequate due diligence are too significant to ignore, and embracing best practices in the due diligence process is crucial for driving M&A success.